Legislative Democrats recently held a hearing on Senate Bill 5770, which would triple the allowable growth rate of property taxes and almost certainly drive record-high rents up even more.

While proponents point to the tax proposal as a way to get much-needed funds to local governments, Sen. Keith Wagoner has introduced two bills to accomplish that goal without punishing already-struggling property owners and renters.

“I’ve seen a lot of bad ideas in Olympia but raising property taxes and rents during a housing-affordability crisis may be one of the worst – and the cruelest,” said Wagoner, R-Sedro-Woolley, who serves on the Senate Ways and Means Committee, which handles tax and budget policy.

“Washington ranks fifth-worst in the country in housing affordability; Tripling the rate of annual growth of property taxes would only add more costs and make homeownership an even more distant dream – especially for young families.

“As I heard repeatedly as a member of the Tax Structure Work Group, increasing property taxes disproportionately affects lower-income renters, as property-tax increases are inevitably passed along in the form of higher rent.

“My legislation would reject this cruel, unfair and regressive approach, and instead provide local governments with a larger share of the liquor and cannabis tax revenue they were intended to receive in the first place.”

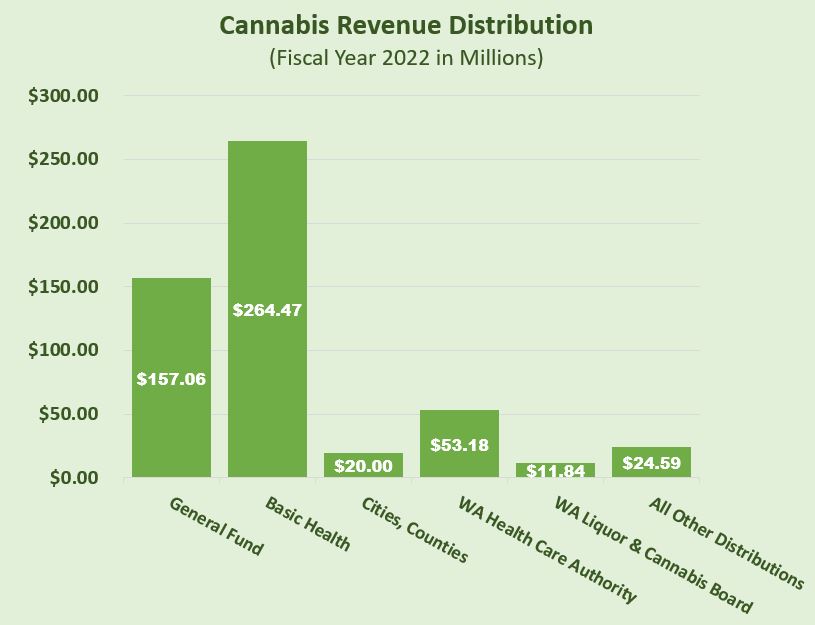

This graph shows the dollar amounts and destination of cannabis revenue. Source: The Liquor and Cannabis Board Annual Report.

Senate Bill 5568 would restore liquor-sales revenue distributions to local governments. Under the bill, 10 percent would go to counties, and 40 percent to incorporated cities and towns.

Senate Bill 5404 would increase cannabis-revenue distributions to local governments. The bill would dedicate 3 percent of cannabis revenue to counties, cities, and towns where licensed cannabis retailers are physically located; and 7 percent to counties, cities, and towns on a per capita basis. Under the bill, counties must receive 60 percent of the distribution based on each county’s total proportional population.

“While the state’s coffers continue to benefit from years of excessive revenue surpluses, and a property-tax increase is not needed at the state level, I realize some local governments are in desperate need of additional revenue,” said Wagoner.

“Rather than raising taxes on hard-working Washingtonians, the two measures I have introduced would provide local government with more resources without increasing the burden on property owners.”

At the Jan. 18 committee hearing on the Democrats’ proposed property-tax hike, the public weighed in loud and clear. More than 8,290 people signed in, with 91.4% opposed to the idea.

“As Washington faces a home-affordability crisis, the approach legislative Democrats support is just more than families and individuals can afford,” Wagoner added. “We want to give people meaningful property tax and rental relief instead, and help our counties and cities in a way that doesn’t put additional burdens on the backs of taxpayers.

“Washingtonians deserve better, and my proposals to increase the share of alcohol and cannabis dollars going to local government are an opportunity for the Legislature to do better.”