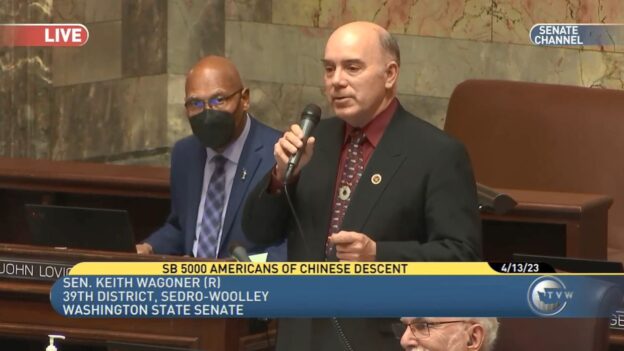

By Sen. Keith Wagoner | Tri-City Herald | April 14, 2023

Click here to read full article.

On the Saturday before Easter, the state Senate’s majority Democrats passed what they call an “assault weapons ban.” In reality, the bill targets several of the most popular sporting and self-defense firearms in the country, including most modern sporting rifles and even some shotguns used for hunting and competition shooting.

My Republican colleagues and I debated the measure for nearly three hours, using the amendment process to try to point out the fallacies of their arguments and mitigate some of the damage the bill would do to the rights of Washingtonians and small business owners who work as legal firearms dealers.

As it turned out, I was the only one able to get an amendment accepted – one to support our military members and allow them to keep their firearms when they are ordered to move to Washington.

The proponents of this bill and I agree on one thing and one thing only. We are in a crisis in Washington. But it is a crisis of general lawlessness across our communities, one exacerbated by bad legislative decisions over the past several legislative sessions.

We have seen soft-on-crime policies, releasing criminals from incarceration; vilification of our law enforcement officers; toleration of life-destroying drug proliferation and use; failure to address mental health adequately; and poor decisions during the COVID lockdowns resulting in learning loss and depression among our youth. We need to focus on addressing the root causes leading to chaos and violence, not vilify firearm ownership.

Our nation has always had a history of gun ownership, and the Second Amendment to the U.S. constitution enshrines our naturally endowed right to defend ourselves and our families. But what we have not always seen – what is new to the moment – is the devastating loss of life we have witnessed due to crime, suicide, mass shootings and senseless violence.

House Bill 1240 declares the violent and inappropriate use of firearms ‘appeal[s] to troubled young men intent on becoming the next mass shooter.’ But where is the effort to help these troubled young males and heal whatever there is inside of them that is broken and leading to violence and rage?

Instead, this bill goes after the implement, and completely ignores the underlying root causes of the problems we see today.

The problems are not just reflected in deaths caused by a demented person with a firearm. We see it in the increase of drug-related deaths, teen suicides, wrong-way and drunk-driving assaults on our roads, and in the sunken eyes of lost souls we see roaming our streets with unattended-to mental-health and substance-abuse issues.

It is reflected in fatherless homes producing rudderless young men who feel hopeless and unsure of their place in this world. It is reflected in the general lawlessness we have seen explode across this state, thanks in large part to the failed policies of the Democrat majority in the Legislature and Governor Inslee.

Banning some of the most popular firearms kept and used by law-abiding citizens today will do nothing to address these problems. Absolutely zero.

Look no further than the City of Seattle. Despite Washington ranking in the Top 10 nationally for gun control for the past five years, we have seen the number of shootings – fatal or not – and ‘shots-fired events’ in our largest city hit an all-time high in 2022.

The fact of the matter is the law created by this bill will just be more of the same. Worse still, it will give the victims of these crimes and all Washingtonians a false sense of security that something is being done.

And let’s not forget that this ban is also blatantly unconstitutional, and likely to cost taxpayers crucial dollars that could be invested in mental health and public safety, but which will instead be used trying to unsuccessfully defend this law in the courts.

HB 1240 now goes back to the House to reconcile changes between the version that passed the Senate and the one that passed the House earlier this year. That means there is still time for lawmakers to do the right thing, put this bill down, and set their sights on real solutions.

— Sen. Keith Wagoner, R-Sedro-Woolley, serves as the Senate Republican Whip and is a member of the Senate Law and Justice Committee.